Rumored Buzz on Vancouver Accounting Firm

Wiki Article

About Virtual Cfo In Vancouver

Table of Contents7 Easy Facts About Outsourced Cfo Services ExplainedSome Ideas on Small Business Accounting Service In Vancouver You Need To KnowAn Unbiased View of Virtual Cfo In VancouverSome Ideas on Vancouver Tax Accounting Company You Should Know

That happens for every solitary transaction you make throughout a given accountancy duration. Working with an accounting professional can aid you hash out those information to make the bookkeeping process work for you.

You make modifications to the journal entries to make certain all the numbers include up. That might consist of making improvements to numbers or managing accrued products, which are expenses or income that you sustain yet don't yet pay for.

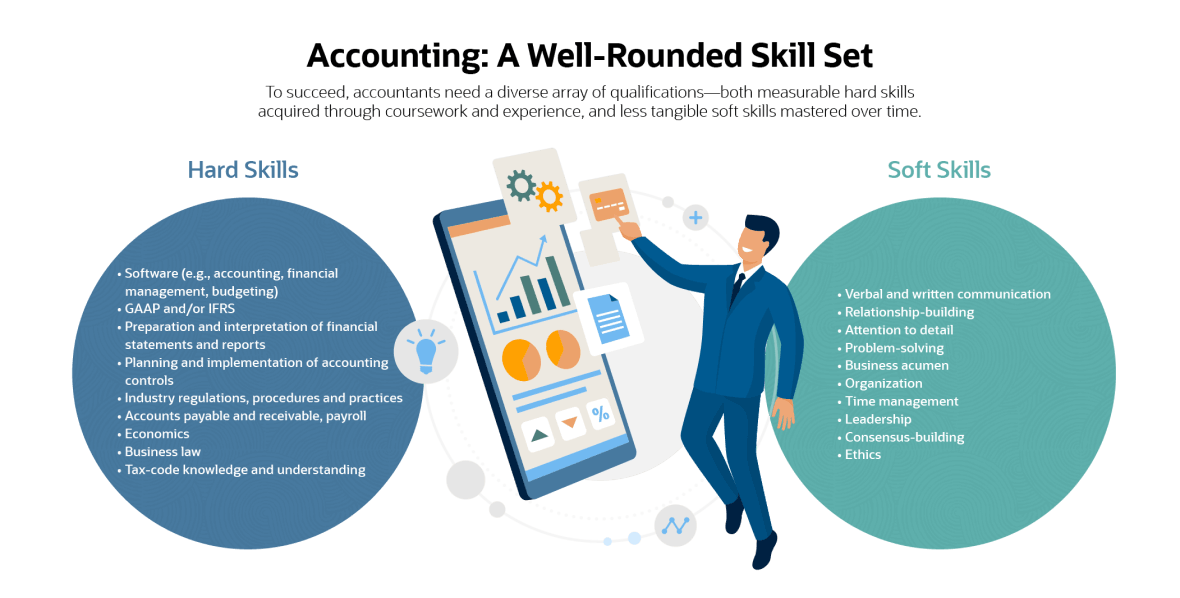

For aiming finance professionals, the question of accountant vs. accountant is usual. Initially, accountants and accountants take the exact same fundamental audit programs. Nonetheless, accountants take place for more training and also education, which results in distinctions in their functions, earnings expectations as well as career development. This guide will provide a detailed break down of what divides accountants from accountants, so you can understand which bookkeeping duty is the most effective suitable for your job desires now as well as in the future.

The Only Guide to Pivot Advantage Accounting And Advisory Inc. In Vancouver

An accounting professional constructs on the information given to them by the accountant. Usually, they'll: Review financial declarations prepared by an accountant. The records reported by the accountant will establish the accountant's recommendations to management, and inevitably, the wellness of the business overall.e., federal government firms, colleges, hospitals, and so on). An educated and also proficient accountant with years of experience and first-hand understanding of accounting applications ismost likelymore certified to run guides for your organization than a recent audit significant grad. Keep this in mind when filtering applications; try not to evaluate candidates based on their education and learning alone.

Future estimates and also budgeting can make or damage your service. Your financial documents will certainly play a big duty when it concerns this. Business estimates as well as fads are based on your historic economic information. They are needed to aid ensure your service continues to be profitable. The monetary data is most reliable and precise when provided with a durable and organized accounting procedure.

Our Outsourced Cfo Services Diaries

Bookkeeping, in the standard sense, has been about as long as there has been business because around 2600 B.C. A bookkeeper's task is to maintain complete records see here of all money that has entered and also gone out of business - CFO company Vancouver. Bookkeepers record everyday purchases in a consistent, easy-to-read means. Their documents allow accounting professionals to do their tasks.Normally, an accountant or owner looks after a bookkeeper's job. An accountant is not an accounting professional, neither need to they be considered an accounting professional. Bookkeepers document economic purchases, article debits and credit reports, produce billings, take care of payroll and maintain and stabilize guides. Accountants aren't required to be accredited to deal with guides for their customers or company but licensing is readily available.

Three major variables affect your prices: the solutions you desire, the expertise you need and also your neighborhood market. The bookkeeping services your service requirements and the amount of time it takes once a week or month-to-month to finish them impact just how much it sets you back to employ a bookkeeper. If you require a person to come to the workplace once a month to fix up guides, it will cost much less than if you require to employ somebody full time to manage your daily operations.

Based upon that calculation, make a decision if Check This Out you require to hire a person permanent, part-time or on a job basis. If you have complex books or are generating a great deal of sales, employ a qualified or certified accountant. A skilled bookkeeper can give you comfort and also self-confidence that your finances are in great hands yet they will also cost you a lot more.

Fascination About Tax Accountant In Vancouver, Bc

If you reside in a high-wage state like New York, you'll pay even more for an accountant than you would certainly in South Dakota. According to the Bureau of Labor Data (BLS), the national typical salary for bookkeepers in 2021 was $45,560 or $21. 90 per hr. There are a number of benefits to employing an accountant to submit as well tax prep services as document your company's economic records.

After that, they may seek added certifications, such as the certified public accountant. Accounting professionals might additionally hold the position of accountant. Nonetheless, if your accounting professional does your bookkeeping, you may be paying greater than you need to for this solution as you would normally pay even more per hr for an accountant than an accountant.

To finish the program, accounting professionals need to have 4 years of relevant job experience. The factor here is that hiring a CFA indicates bringing highly sophisticated accounting understanding to your business.

To obtain this certification, an accountant needs to pass the needed tests and have 2 years of specialist experience. You might employ a CIA if you want an extra specific emphasis on monetary danger evaluation and protection tracking processes.

Report this wiki page